I’m 3.5 years into my 5 year plan and I’m on track to hit my goal. I’ve invested in companies either directly, through syndicates, via funds, a venture studio, some crowd funding sprinkled in, and leading this year to the launch of my own investing syndicate Interlock Capital.

My journey to be an angel investor has been met with obstacles (not enough capital, not an accredited investor), but new government policy has opened up some new and creative ways that allow folks like me to invest in some very exciting companies. Why angel invest? I’ve been lucky to have incredible mentors and investors on my entrepreneurial journey. I doubt I’ll ever be able to fully pay it back, but I can sure try! Angel investing is one way for me to do that. Plus it’s fun for me!

Even if I were accredited back then, I wasn’t in a position to write $50k or even $25k checks into a single company. This is typically the minimum required to invest directly with a sought-after startup. Actually, I probably COULD write that big of a check. The problem is that would be the ONLY check I’d be able to write for a long time. Meaning, I’d be putting all of my eggs into one basket. For angel investing, that’s a recipe for disaster.

90% of startups go to zero. They fail. 75% of funded startups fail. There are plenty of other stats out there like these. This is a risky business. It’s not for the faint of heart. This is nothing like investing in the stock market, mutual funds, or even higher risk/reward investments like hedge funds. The way to win here is to invest into a LOT of companies. Diversify. Get more swings at bat. Leverage whatever budget you have, and split it amongst as many companies as you can.

A LITTLE BACKSTORY

Which leads me back to my original problem. In 1998 I left my cushy Detroit auto industry job at Chrysler and moved to San Diego sight-unseen. I took a year off to hit the reset button and in 1999 I became the 2nd employee of a startup company called Network Insight. My entrepreneurial journey began here. As did my desire to become an angel investor.

What I’m saying is that 22 years ago I wanted to be an angel investor. But I never had the capital to do it properly. Could I have joined a venture firm? Sure, but I was also too busy founding and growing companies to take that approach. So, I continued my entrepreneurial journey in the hopes that I would financially get there some day.

MY FIRST INVESTMENT

Fast forward to just under four years ago. I had recently sold my company. I had a little extra capital, but not a lot. I was heads down being an intrapreneur at Seismic building some awesome new technology. Somewhere along the way I was invited to a dinner w/ Arlan Hamilton and was compelled to make my first angel investment into Backstage. It was a small investment for her, but for me it was the perfect size.

I knew the world had changed and the Jobs Act was a stepping stone allowing more people to invest. I knew that syndicates had been gaining popularity (more on those later). I had been following along passively and even wrote about the Jobs Act back in 2012. But this moment with Arlan was the spark that re-awakened my fire to angel invest. I realized it was time to dip my toes in.

MY PLAN

First, I wanted to set some goals. I knew I wanted to get into as many companies as I could with a very limited budget, which would require some creativity. So I kept it pretty simple:

Be financially invested in 100 companies within 5 years.

Al’s Angel Investing Goal, 2018

Al, dude, that doesn’t sound like “dipping your toes in”! True. Any of you that know me well enough know that I don’t typically go half-in. The beauty of todays world is that you can actually do this without it being a distraction or a full-time job. But still, 100 companies? Five years? That’s 20 per year!

It’s aggressive, I agree. But it’s right for ME. Maybe you have a $5,000 annual budget and want to invest in 5 companies per year. There are plenty of places you can invest with as little as $1000 per company or less (more on those below). Build your own model that works for you!

PROGRESS 3.5 YEARS IN

As of this publish date (2021.03.23) I have made exactly 71 investments in some awesome companies. My annual budget has varied anywhere between $15,000 to $50,000 depending on personal cash flow, exposure to other asset classes, and of course the number of companies I’m excited to invest in.

HOW I DID IT

Just to be sure we’re on the same page here. I am NOT a financial or investment advisor. Do your own research. Make your own investments. Consult a wealth manager or investment professional. None of those things are me. Do what is right for you!

YEAR 1

My first year was a combination of direct investments and the Tech Coast Angels San Diego yearly ACE Fund.

- The ACE fund is a yearly fund that the San Diego chapter of TCA created and it’s genius. You can invest in $10k chunks each year and they invest that capital across 10-20 companies throughout that year. For each $10k chunk you invest you also get a vote for whether a company gets investment and how much! Love this model because they have smart folks doing diligence and you get allocation into a lot of companies for a modest price.

- ACE Fund 19 Annual Report

- ACE Fund 20 Annual Report

- ACE Fund 21 is in progress!

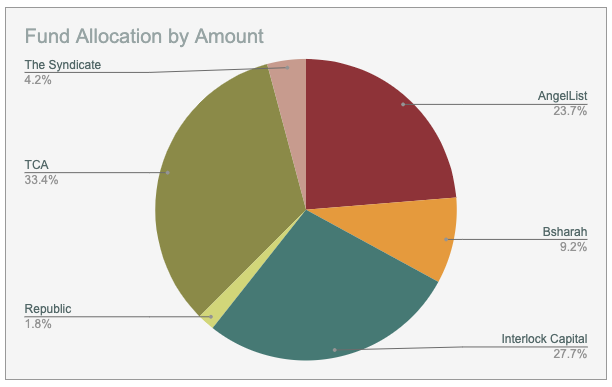

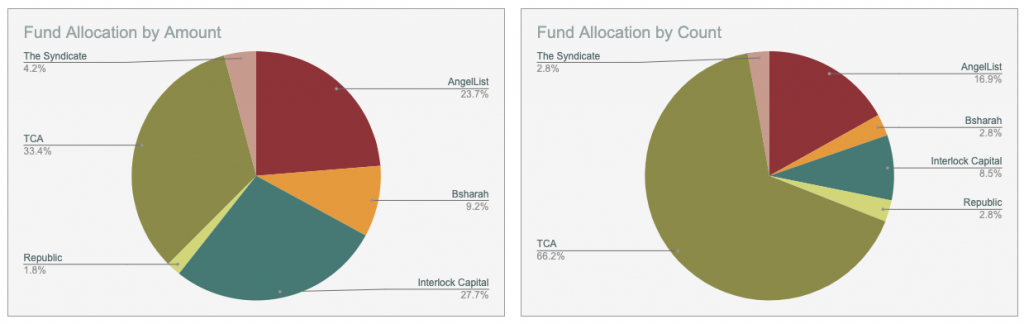

The charts below show that I have the majority of my investments through TCA, but not the majority of my money. I’m very conscious of making sure I’m not over-allocated financially in any one fund allocation.

YEAR 2

My second year was more of the same, but I added in AngelList Syndicates. AngelList popularized the syndicate style of investing over just the past few years.

Syndicate 101:

- A lead investor has a company they want to invest in. They invite other people to invest along-side them.

- An LLC is formed to invest in this one specific company (called a Special Purpose Vehicle, or SPV). Investors put money into the SPV and they own a portion of that entity.

- That SPV entity then invests in the startup. So, investors then own a proportional share of that startup through the SPV.

- Many syndicates will allow for low-dollar-value investments.

- You get to pick and choose the companies you want to invest in.

- There are a bunch of syndicate options out there. Deal quality varies, so do your homework. You want to make sure you trust whoever is providing the deal and doing diligence on your behalf.

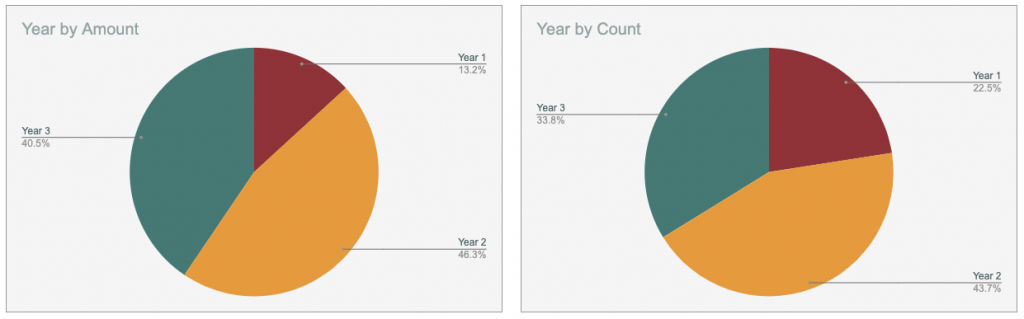

You can also glean from the above charts that more than 50% of my dollars have gone into syndicate investing. The chart below shows investment and capital allocation by year.

YEAR 3

My third year added in The Syndicate (Jason Calacanis’ syndicate), Republic (a crowdfunding platform), and my new venture capital company Interlock Capital (a community-driven syndicate I’ve created with my partner Neal Bloom). I stopped my AngelList investments this year because of the investments I’m making via Interlock.

At Interlock we find, evaluate, fund, and support companies together as a community of angel investors. It’s a unique model and is working great. The website tells the full story so I’ll let you dig in there.

ADDITIONAL CHARTS

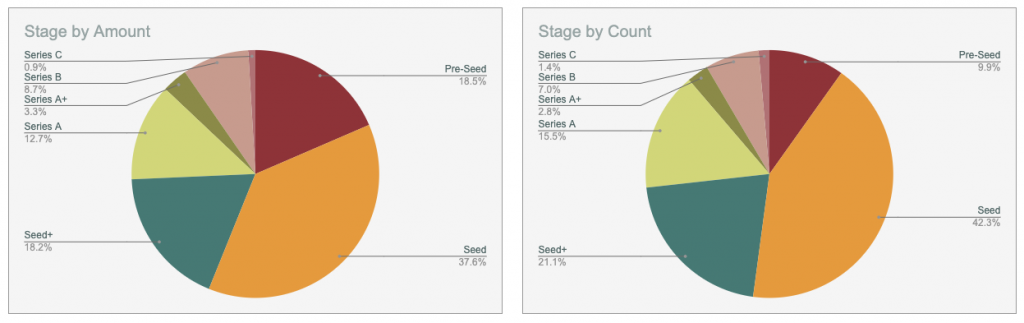

This one shows my investment allocation by company stage. Around 75% of my investments thus far has been pre-seed or seed stage. But having 25% of my investments be in later stage Series A, B, C deals (like Mercato) is awesome. I’d never have been able to get into those kinds of deals on my own.

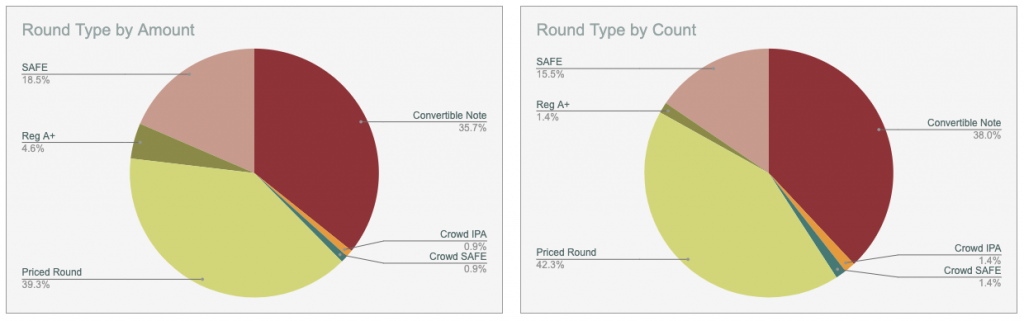

This one shows my investment allocation by the type of round. A fair distribution of convertible instruments and equity rounds.

CONCLUSION

If you WANT to be an angel investor, there’s no excuse. Build yourself a plan, a budget, and get to work! Find the platform(s) you like, trust, and are willing to invest with. Since you’re not investing directly that means someone is doing diligence on the companies and presenting a subset of that information to you. It’s important you trust those sources.

It’s also important to note that in order to invest you might need to meet certain criteria. Some examples (not an exhaustive list):

- To invest with a syndicate (Interlock, AngelList, The Syndicate), in most cases you’ll need to be an Accredited Investor.

- If you’re not accredited you still have options. Crowdfunding has far fewer restrictions. Republic has a pretty extensive help section and you can start here to get a high level overview.

Choose the ones that make you comfortable and jump in! Hit me on Twitter if you have questions!